Welcome to our comprehensive guide on the art of fundamental analysis. As investors, understanding the market and making informed investment decisions is crucial. Fundamental analysis allows us to do just that by combining economic insights with trading strategy. By analyzing the factors that drive an asset’s intrinsic value, we can gain valuable insights into its potential for growth or decline.

In this article, we will explore the key principles of fundamental analysis, how it can be used to inform trading strategies, and its role in shaping investment decisions. We will explore different types of fundamental analysis, such as global economic overview and industry-specific assessments. Additionally, we will discuss the strategic importance of fundamental analysis in trading and how it can be integrated with other analysis techniques.

Unlock the Secret to Forex Success with BOB James’ Top-Performing Signals! Experience the Ease of Proven, MyFXbook-Verified Strategies and Transform Your Trading Journey Today. Don’t Miss Out on Exceptional Performance – Join Now!

Whether you’re a novice investor or a seasoned trader, understanding fundamental analysis can provide you with a competitive edge in the market. So let’s dive in and unlock the secrets behind this powerful methodology that combines economic insights with effective trading strategies.

Key Takeaways:

- Fundamental analysis combines economic insights with trading strategy to make informed investment decisions.

- It involves analyzing factors that influence the intrinsic value of an asset to determine its potential for growth or decline.

- There are different types of fundamental analysis, including global economic overview and industry-specific assessments.

- Integrating fundamental analysis with other analysis techniques can enhance trading strategies.

- Understanding fundamental analysis can provide a competitive edge in the market.

What Is Fundamental Analysis?

Fundamental analysis is a key pillar of financial analysis that plays a crucial role in investment decision-making. It involves evaluating the intrinsic value of an asset by analyzing its underlying financial and economic factors. By examining a company’s financial statements, economic indicators, and industry trends, fundamental analysis helps investors identify opportunities and make informed investment decisions.

The Core Definitions

At its core, fundamental analysis involves assessing a company’s financial health, its competitive position in the market, and the overall economic conditions that can impact its performance. It focuses on understanding the factors that drive a company’s value and growth potential, such as revenue, earnings, cash flow, and market dynamics.

Some of the key concepts and metrics used in fundamental analysis include:

- Earnings per share (EPS)

- Price-to-earnings ratio (P/E ratio)

- Debt-to-equity ratio

- Return on equity (ROE)

- Dividend yield

- Market capitalization

These metrics provide insights into a company’s profitability, financial stability, and growth potential, helping investors assess its overall value and investment viability.

Anecdotal Relevance in Everyday Decisions

While fundamental analysis is often associated with investments in stocks and bonds, its principles extend beyond the financial markets. The core concepts of fundamental analysis have anecdotal relevance in everyday decision-making.

For example, when purchasing a car, you would likely consider factors such as the vehicle’s performance, reliability, fuel efficiency, safety features, and brand reputation. Similarly, in the real estate market, factors such as location, property condition, rental demand, and market trends influence property valuations and investment decisions.

By applying fundamental analysis principles to everyday decisions, individuals can make more informed choices based on a comprehensive assessment of relevant factors and potential outcomes.

The Strategic Role of Fundamental Analysis in Trading

Fundamental analysis plays a strategic role in trading by providing traders with valuable insights into the fundamental factors that drive asset prices. It involves evaluating various economic and financial factors to determine the intrinsic value of an asset. By understanding the strategic role of fundamental analysis, traders can make informed investment decisions and potentially achieve greater trading success.

One of the key benefits of incorporating fundamental analysis into trading strategies is the ability to identify undervalued and overvalued assets. By analyzing factors such as company financials, industry trends, and macroeconomic indicators, traders can spot opportunities where assets are priced below their true value or overpriced relative to their fundamentals.

This strategic analysis enables traders to make investment decisions based on the long-term potential of an asset rather than short-term market fluctuations. By identifying undervalued assets, traders can position themselves to benefit from the potential appreciation in value over time. On the other hand, recognizing overvalued assets allows traders to avoid potential losses or even profit from short-selling opportunities.

Incorporating fundamental analysis into trading strategies also helps traders to assess the overall market conditions and make more strategic decisions. By understanding the underlying factors that influence asset prices, traders can gauge the market sentiment and adjust their trading strategies accordingly. This strategic approach allows traders to align their trades with the prevailing market trends and potentially capitalize on profitable opportunities.

Furthermore, fundamental analysis provides traders with a deeper understanding of the underlying forces that drive market dynamics. By analyzing economic indicators, industry trends, and company financials, traders can gain insights into the factors that impact supply and demand, as well as the overall health of the economy. This knowledge allows them to anticipate market movements and adjust their trading strategies accordingly.

Understanding the Two Main Types of Fundamental Analysis

In fundamental analysis, there are two main types that investors and traders rely on to make informed decisions: global economic overview and macroeconomic analysis, and industry-specific assessment and financial analysis of companies. Each type offers unique perspectives and contributes to a comprehensive understanding of the market.

Global Economic Overview and Macroeconomic Analysis

Global economic overview and macroeconomic analysis focus on assessing the overall state of the economy and its impact on various asset classes. It involves analyzing factors such as GDP growth, inflation rates, interest rates, employment trends, and government policies. By examining these economic indicators, traders can gain insights into the broader market trends and identify opportunities or risks.

Industry-Specific Assessment and Financial Analysis of Companies

Industry-specific assessment and financial analysis of companies involve evaluating the financial health and performance of individual companies within specific industries. This type of analysis includes analyzing financial statements, such as balance sheets, income statements, and cash flow statements, to determine a company’s profitability, liquidity, and overall financial stability. Additionally, industry-specific analysis considers factors such as competitive dynamics, market trends, and regulatory environment to assess the growth potential and risks of specific companies.

By combining both global economic overview and macroeconomic analysis, and industry-specific assessment and financial analysis of companies, traders can gain a holistic view of the market. This comprehensive understanding allows for more informed investment decisions and improves the chances of achieving favorable outcomes.

Insights into Top-Down and Bottom-Up Analysis

When it comes to fundamental analysis, two commonly used approaches are top-down analysis and bottom-up analysis. These approaches provide valuable insights into the market, allowing traders to make informed investment decisions.

Top-down analysis involves starting with a big-picture view of the economy and analyzing macroeconomic factors that may impact the market as a whole. Traders using this approach focus on factors such as GDP growth, interest rates, inflation, and geopolitical events. By understanding the broader economic landscape, they can identify market trends and position themselves accordingly.

On the other hand, with bottom-up analysis, traders delve into the details of individual companies or assets. They evaluate specific financial indicators, industry trends, company management, and competitive factors. By conducting thorough research and analysis on individual entities, traders utilizing bottom-up analysis aim to identify undervalued or overvalued assets.

It is important to note that both top-down and bottom-up analysis have their strengths and limitations. Top-down analysis provides a broad perspective on the market and can uncover valuable insights into overall trends. However, it may overlook important details at the individual company level. On the contrary, bottom-up analysis allows for a detailed assessment of specific assets, but it may miss out on broader market trends.

“Top-down analysis helps me understand the bigger picture, while bottom-up analysis allows me to find hidden gems within the market.” – John Smith, experienced trader.

By combining both top-down and bottom-up analysis, traders can gain a comprehensive understanding of the market. This holistic approach maximizes the potential for spotting investment opportunities and managing risks effectively.

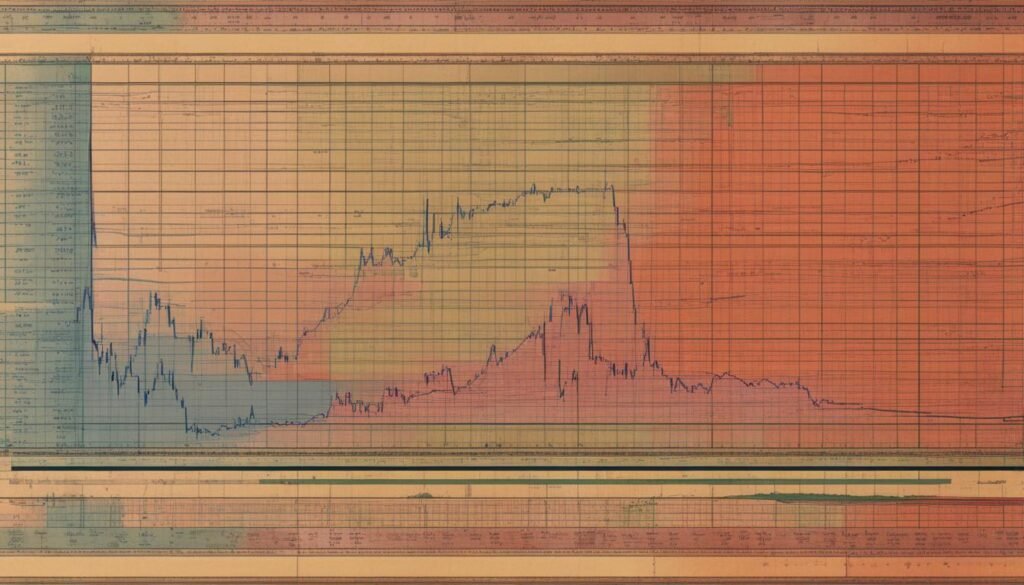

The image below provides a visual representation of the top-down and bottom-up analysis approaches:

Demystifying the Mechanism of Fundamental Analysis

In the world of trading, fundamental analysis plays a crucial role in guiding investment decisions. But what exactly is the mechanism behind this approach? How does it work? In this section, we will demystify the mechanism of fundamental analysis and shed light on its application in trading.

Systematic and Discretionary Trading Styles Explained

When it comes to applying fundamental analysis, traders often adopt either a systematic or discretionary trading style. Let’s take a closer look at each of these styles:

Systematic Trading Style: Traders following a systematic trading style rely on predefined rules and algorithms to guide their investment decisions. They use quantitative models and data-driven approaches to analyze financial and economic indicators. By systematically evaluating the fundamentals of various assets, traders can make objective and consistent trading decisions.

Discretionary Trading Style: On the other hand, traders who prefer a discretionary trading style base their investment decisions on their own judgment and intuition. They use fundamental analysis as a tool to gain insights into market dynamics, but the final decisions are made based on their subjective assessment of the information. Discretionary traders have the flexibility to adapt their strategies based on changing market conditions and their own expertise.

Both systematic and discretionary trading styles have their own advantages and disadvantages. Systematic trading can remove emotional biases and ensure consistency, while discretionary trading allows for adaptability and a more personalized approach. The choice between the two depends on a trader’s preferences, risk tolerance, and trading goals.

In the context of fundamental analysis, both trading styles can be applied effectively. Regardless of the chosen style, the goal remains the same – to use fundamental analysis to gain insights into the intrinsic value of assets and make informed investment decisions.

Fundamental Analysis and Trading Strategy

When it comes to trading, fundamental analysis plays a crucial role in informing trading decisions and enhancing the effectiveness of trading strategies. By evaluating the intrinsic value of assets based on financial and economic factors, fundamental analysis provides valuable insights that traders can leverage to make informed investment decisions.

But how exactly does fundamental analysis intersect with trading strategy? Let’s explore.

One of the key aspects of incorporating fundamental analysis into trading strategies is understanding how economic indicators and market trends can impact asset prices. By keeping a close eye on economic data releases and macro trends, traders can identify potential opportunities and make strategic trading decisions.

For example, by analyzing economic indicators such as GDP growth, inflation rates, and interest rates, traders can gain insights into the overall health of an economy and adjust their trading strategies accordingly.

Another way fundamental analysis enhances trading strategies is by providing a deeper understanding of individual companies and industries. By conducting industry-specific assessments and financial analysis, traders can identify undervalued or overvalued assets, allowing them to make well-informed trading decisions.

For instance, if fundamental analysis reveals that a company’s financials are strong and its industry is experiencing favorable conditions, traders may decide to go long on the stock as part of their trading strategy.

Incorporating fundamental analysis into trading strategies also helps traders navigate market volatility and make more informed risk management decisions. By understanding the underlying fundamental factors that drive asset prices, traders can better anticipate market movements and adjust their positions accordingly.

To effectively incorporate fundamental analysis into trading strategies, it’s important to stay updated on relevant news and economic developments. Being aware of upcoming economic data releases, major policy announcements, and industry-specific events can help traders make timely decisions based on fundamental analysis.

By combining fundamental analysis with other analytical tools such as technical analysis, traders can create a well-rounded trading strategy that leverages both the long-term insights provided by fundamental analysis and the short-term price patterns identified through technical analysis.

For example, a trader may choose to use fundamental analysis to identify a long-term bullish outlook on a particular stock based on financial performance and industry trends, while using technical analysis to pinpoint entry and exit points based on short-term price patterns.

Incorporating fundamental analysis into trading strategies requires a systematic approach and a deep understanding of the factors that influence asset prices. By leveraging the insights provided by fundamental analysis in combination with other analytical techniques, traders can enhance their trading strategies and make more informed investment decisions.

Next, we will explore the comparative study of systematic trading and discretionary trading, highlighting the factors traders should consider when choosing between these two trading styles and how fundamental analysis can be applied in each approach.

Systematic vs Discretionary Trading: A Comparative Study

In the world of trading, two primary approaches dominate the landscape: systematic trading and discretionary trading. While both methods aim to generate profits, they differ significantly in their execution, decision-making processes, and level of automation.

Systematic trading is a strategy that relies on predefined rules and algorithms to execute trades. It is characterized by its systematic and data-driven approach, where trading decisions are based on quantifiable factors and historical data analysis. This method eliminates emotional bias and subjectivity, as trades are executed based on predetermined parameters. Systematic traders often use sophisticated computer programs and automated systems to scan markets, identify patterns, and execute trades.

Discretionary trading, on the other hand, relies on the trader’s expertise, skill, and intuition to make trading decisions. It involves a more subjective and intuitive approach, where traders use their judgment, market knowledge, and experience to assess opportunities and execute trades. Discretionary traders often rely on fundamental analysis, technical indicators, and market sentiment to guide their decision-making process. This approach allows for flexibility and adaptability, as traders can quickly respond to emerging market conditions and adjust their strategies accordingly.

Table: Comparative Analysis of Systematic and Discretionary Trading

| Aspect | Systematic Trading | Discretionary Trading |

|---|---|---|

| Decision-Making | Rules-based and automated | Subjective and intuitive |

| Emotional Bias | Minimized, as trades are executed based on predefined rules | Potential for emotional bias, as human judgment plays a significant role |

| Execution | Executed by computer programs and automated systems | Executed manually by the trader |

| Flexibility | Less flexible, as trades are based on predefined parameters | Highly flexible, as traders can adapt quickly to changing market conditions |

| Data Analysis | Rigorous analysis of historical data and quantitative factors | Relies on fundamental analysis, technical indicators, and market sentiment |

When considering which trading approach to adopt, traders should carefully evaluate their personal preferences, risk tolerance, and trading goals. Systematic trading offers the advantage of consistency, objectivity, and the ability to execute trades automatically. It is well-suited for traders who prefer a systematic and rule-based approach and are comfortable relying on quantitative analysis. Discretionary trading, on the other hand, appeals to traders who value flexibility, intuition, and the ability to adapt to changing market conditions. It requires a deep understanding of fundamental analysis, technical indicators, and the ability to make informed trading decisions.

Both systematic and discretionary trading have their advantages and disadvantages, and there is no one-size-fits-all approach. Successful traders often employ a combination of both strategies, leveraging the strengths of each approach to enhance their trading outcomes. Additionally, fundamental analysis can be integrated into both systematic and discretionary trading styles to further inform trading decisions and improve overall performance.

By understanding the key differences between systematic and discretionary trading and aligning them with their own trading objectives, traders can make well-informed decisions and choose the approach that suits them best.

Real-World Examples of Fundamental Analysis at Work

In this section, we will delve into real-world examples that showcase the practical application of fundamental analysis. By examining case studies in stock valuations and assessing macro trends in forex trades, we will highlight the effectiveness of fundamental analysis in making informed investment decisions.

Case Studies in Stock Valuations

One of the key applications of fundamental analysis is in evaluating the value of a company’s stock. By conducting a thorough analysis of financial statements, market trends, and industry factors, investors can determine whether a stock is overvalued or undervalued.

Let’s take the case study of Company XYZ, a leading technology firm. Through fundamental analysis, investors can assess XYZ’s revenue growth, profitability, and competitive position. By comparing these factors with industry benchmarks and conducting a discounted cash flow analysis, investors can determine the fair value of XYZ’s stock. This analysis provides valuable insights into whether the stock is a good investment opportunity.

Furthermore, fundamental analysis helps investors identify potential risks and vulnerabilities in a company’s financial health. By examining factors such as debt levels, cash flow, and management quality, investors can gain a comprehensive understanding of the company’s financial stability and make more informed investment decisions.

Assessing Macro Trends in Forex Trades

Forex traders utilize fundamental analysis to assess macro trends that impact currency exchange rates. By analyzing economic indicators, geopolitical events, and central bank policies, traders can anticipate currency movements and make profitable forex trades.

For example, let’s consider the impact of a country’s interest rate policy on its currency value. If a central bank decides to raise interest rates to control inflation, this can attract foreign investors seeking higher returns. As a result, the demand for that country’s currency may increase, leading to an appreciation in its value. By staying informed about global economic trends and policy decisions, forex traders can capitalize on these opportunities and maximize their trading profits.

Overall, these real-world examples demonstrate the practical application of fundamental analysis in investment decision-making. Whether it’s evaluating stock valuations or assessing macro trends in forex trades, fundamental analysis provides valuable insights that enable informed investment decisions.

Limitations and Considerations in Fundamental Analysis

Understanding the Shortcomings

While fundamental analysis is a powerful tool for evaluating investments, it is important to recognize its limitations and consider the potential shortcomings. One significant drawback of fundamental analysis is its heavy reliance on historical data. The analysis is based on past financial performance and economic indicators, which may not always accurately predict future outcomes. Market conditions can change rapidly, making historical data less relevant in certain situations.

Moreover, fundamental analysis is not immune to market dynamics and external factors that can influence investment decisions. Fluctuations in market sentiment and economic trends can impact the effectiveness of fundamental analysis, as they may overshadow fundamental factors temporarily. This requires investors to continuously assess market dynamics and adapt their analysis accordingly.

Another consideration in fundamental analysis is the influence of investor biases. Emotions, cognitive biases, and herd mentality can skew the interpretation of fundamental factors and lead to biased investment decisions. It is important for investors to be aware of their own biases and employ objective reasoning when conducting fundamental analysis.

Confronting Market Dynamics and Investor Biases

To navigate the limitations and considerations of fundamental analysis effectively, traders and investors must take a proactive approach. Here are some strategies to address these challenges:

- Combine fundamental analysis with other analytical approaches: By incorporating other analysis techniques such as technical analysis or sentiment analysis, investors can gain a more comprehensive view of the market and reduce the impact of individual limitations.

- Stay informed about market trends: Regularly monitoring and staying updated on market dynamics, economic trends, and geopolitical factors can help investors adjust their fundamental analysis to changing conditions.

- Conduct thorough research and due diligence: Investors should conduct extensive research, verify data sources, and critically analyze financial statements to ensure accurate and reliable information for their fundamental analysis.

- Practice disciplined decision-making: Recognizing and managing investor biases is crucial. By following a disciplined approach and adhering to a well-defined investment strategy, investors can mitigate the influence of biases and make more rational decisions.

Overall, while fundamental analysis has its limitations and considerations, it remains a valuable tool for evaluating investments. By understanding these shortcomings, confronting market dynamics, and managing investor biases, traders and investors can effectively leverage fundamental analysis to make informed and rational investment decisions.

Integrating Technical Analysis with Fundamentals

In the world of trading, the integration of technical analysis with fundamental analysis has become a popular approach for making informed investment decisions. By combining these two complementary methods, traders can gain a deeper understanding of market trends and potential opportunities. In this section, we will explore how technical analysis and fundamental analysis can be effectively balanced to enhance trading strategies.

Balancing Fundamental with Technical Indicators

When integrating technical analysis with fundamentals, traders must strike a balance between the two approaches. Fundamental analysis involves assessing the intrinsic value of an asset based on economic and financial factors such as earnings reports, financial statements, and industry trends. On the other hand, technical analysis focuses on analyzing market data, historical price movements, and trends using various indicators and chart patterns.

By incorporating technical indicators into the fundamental analysis process, traders can gain a more comprehensive view of the market. For example, they can use technical indicators like moving averages, oscillators, and trend lines to identify potential entry and exit points in conjunction with fundamental analysis. This integration allows traders to validate their fundamental analysis with technical signals and enhance the timing of their trades.

Traders must also consider the time frame in which they are trading. Short-term traders may rely more heavily on technical analysis, using indicators to identify short-term price movements. Long-term investors, on the other hand, may place greater emphasis on fundamental analysis to assess the long-term growth prospects of an asset.

Case Studies – Synergized Approaches in Trading

Let’s take a look at two case studies that illustrate the benefits of integrating technical analysis with fundamentals:

- Company XYZ: Fundamental analysis reveals strong financials and positive industry outlook. However, technical analysis indicates a short-term downward trend. By balancing these signals, a trader decides to wait for the stock price to stabilize based on technical indicators before entering a long-term position, ensuring a more favorable entry point.

- Currency Pair ABC: Fundamental analysis suggests that a particular currency is undervalued due to positive economic indicators. Technical analysis shows an oversold condition based on specific indicators. By combining these insights, a trader takes advantage of the undervalued currency by entering a long position, supported by the technical analysis signal.

These case studies demonstrate how the integration of technical analysis with fundamental analysis can provide traders with a more holistic and synergized approach to trading. By considering both technical and fundamental factors, traders can make more informed decisions and potentially improve their trading performance.

By integrating technical analysis with fundamentals, traders can achieve a unique perspective on the market, leveraging the strengths of both approaches. This balance allows traders to make more well-rounded and informed trading decisions. In the next section, we will delve into fine-tuning trading strategies with the right fundamental analysis approach.

Fine-Tuning Your Trading with The Right Fundamental Analysis Strategy

When it comes to trading, having a solid strategy is key to success. And one crucial aspect of developing a winning strategy is fine-tuning it with the right fundamental analysis strategy. By incorporating fundamental analysis into your trading approach, you can gain valuable insights into market trends and make more informed trading decisions.

But how do you go about selecting the right fundamental analysis strategy for your trading style? It starts with understanding your goals, risk tolerance, and preferred trading timeframe. By tailoring your fundamental analysis approach to these factors, you can better align your strategy with your individual needs and objectives.

Here are some practical tips to help you select the right fundamental analysis strategy:

- Identify your trading style: Determine whether you are a long-term investor or a short-term trader. This will influence the type of fundamental analysis that is most relevant for you.

- Consider your risk tolerance: Assess how much risk you are comfortable with and adjust your strategy accordingly. Some fundamental analysis strategies may be more conservative, while others may be more aggressive.

- Focus on relevant indicators: Identify the key economic indicators and financial metrics that align with your trading goals. By focusing on the factors that are most relevant to your trading strategy, you can obtain more accurate insights.

- Stay updated: Continuously evaluate and adapt your strategy based on changing market conditions and economic trends. Stay informed about the latest news and developments that impact your chosen fundamental analysis strategy.

By fine-tuning your trading with the right fundamental analysis strategy, you can enhance your ability to identify profitable trading opportunities and mitigate unnecessary risks. Remember, finding the perfect strategy may require some trial and error, so be open to adjusting and refining your approach as needed.

Overall, incorporating a strong fundamental analysis strategy into your trading can make a significant difference in your overall profitability and success. Take the time to carefully consider your trading style, goals, and risk tolerance, and select the fundamental analysis strategy that best aligns with your individual needs. With the right strategy in place, you’ll be well-equipped to navigate the dynamic world of trading and make informed decisions.

Tactical Approaches to Economic Indicators in Trading Strategies

When it comes to successful trading strategies, understanding and effectively utilizing economic indicators can be a game-changer. Economic indicators provide valuable insights into the health and performance of economies, industries, and companies, giving traders an edge in making informed decisions. In this section, we will explore tactical approaches to incorporating economic indicators into trading strategies, helping you optimize your trading approach and capitalize on market opportunities.

Leveraging Economic Indicators

Economic indicators are statistical data points that provide information about current economic conditions or trends. They can range from employment figures and consumer spending to inflation rates and gross domestic product (GDP). By monitoring and analyzing these indicators, traders can gain valuable insights into the economic environment and make more accurate predictions about future market movements.

There are various tactical approaches to incorporating economic indicators into trading strategies. Here are a few key strategies:

- Fundamental Analysis: Utilizing economic indicators in fundamental analysis involves evaluating the impact of economic factors on the value of an asset or market. Traders can analyze indicators such as GDP growth rates, interest rates, and inflation levels to assess the overall economic health and make informed investment decisions. This approach is particularly popular among long-term investors and value-oriented traders.

- Event-driven Trading: Certain economic indicators, such as non-farm payroll reports or central bank announcements, have a significant impact on market volatility and direction. Traders can adopt an event-driven trading strategy, where they closely monitor the release of key economic indicators and capitalize on the resulting market movements. This approach requires agility and the ability to analyze and react quickly to new information.

- Data Analysis: Traders can utilize economic indicators as part of their data analysis to determine patterns, trends, and correlations. By combining economic indicators with technical analysis and other data points, traders can identify potential trading opportunities and develop more robust strategies.

Key Economic Indicators

While there are numerous economic indicators available, some key indicators have a significant impact on trading strategies. Here are a few essential economic indicators that traders should monitor:

- Interest Rates: Changes in interest rates have a profound effect on financial markets, particularly in the forex and bond markets. Traders should pay close attention to central bank announcements regarding interest rates, as they can influence currency values and bond yields.

- Unemployment Rate: The unemployment rate provides insights into the overall health of an economy. Lower unemployment rates often indicate a stronger economy and increased consumer spending, which can positively impact stock markets.

- Inflation Rate: Inflation rates measure the pace at which prices for goods and services increase over time. High inflation rates can erode purchasing power and have negative implications for certain asset classes, such as fixed-income investments.

- Consumer Confidence: Consumer confidence refers to the level of optimism or pessimism consumers have regarding the future state of the economy. It is a key indicator of consumer spending and can provide insights into future market trends.

The Power of Data-Driven Decisions

Incorporating economic indicators into trading strategies empowers traders to make data-driven decisions based on objective information about market conditions. By leveraging tactical approaches to economic indicators, traders can enhance their trading strategies, minimize risks, and seize profitable opportunities. Remember, staying informed and adapting your strategies to evolving economic indicators is a key to achieving trading success.

Conclusion

Recap: The Synergy of Fundamental Analysis and Trading Strategy

In conclusion, fundamental analysis and trading strategy form a powerful synergy that enables informed investment decisions. Throughout this article, we have explored the concept of fundamental analysis and its role in assessing the intrinsic value of assets based on economic and financial factors. We have discussed how fundamental analysis combines economic insights with trading strategy to guide traders in identifying undervalued and overvalued assets, ultimately enhancing their chances of success in the market.

By leveraging fundamental analysis, traders can gain a deeper understanding of market trends and make more strategic trading decisions. This approach involves analyzing global economic indicators and conducting industry-specific assessments and financial analysis of companies. It empowers traders to capitalize on opportunities while minimizing risks, leading to improved trading outcomes.

Looking Forward: The Future of Fundamental Analysis in Trading

As we look to the future, fundamental analysis is poised to continue evolving in response to advancements in technology, changes in market dynamics, and the increasing availability of data. Traders will have access to more sophisticated analytical tools and resources that provide real-time insights and help them make more accurate predictions.

The integration of fundamental analysis with technical analysis will also gain prominence, allowing traders to effectively combine both approaches to gain a comprehensive understanding of the market. This synergized approach will provide a more holistic view of asset valuation and market trends, giving traders a competitive edge.

In conclusion, fundamental analysis will remain a crucial aspect of trading success, enabling traders to make well-informed investment decisions. By embracing the power of fundamental analysis and continuously adapting to the evolving landscape, traders can position themselves for long-term profitability and achievement in the dynamic world of trading.

FAQ

What is fundamental analysis?

Fundamental analysis is an approach used in trading to evaluate the intrinsic value of an asset based on financial and economic factors. It involves analyzing various aspects such as company financials, economic indicators, and industry trends to make informed investment decisions.

Why is fundamental analysis important in trading?

Fundamental analysis is important in trading as it helps traders identify undervalued and overvalued assets, allowing them to make strategic investment decisions. By considering the fundamental factors that drive a market, traders can gain a deeper understanding of the potential value of an asset and make more informed trading decisions.

What are the two main types of fundamental analysis?

The two main types of fundamental analysis are global economic overview and macroeconomic analysis, which involve analyzing broader economic factors, and industry-specific assessment and financial analysis of companies, which focus on evaluating specific companies and their financial health.

What is the difference between top-down and bottom-up analysis in fundamental analysis?

Top-down analysis involves starting with a broad assessment of macroeconomic factors, such as economic trends and geopolitical events, to identify market trends and potential investment opportunities. Bottom-up analysis, on the other hand, involves evaluating specific companies or assets based on their individual financials and industry dynamics. Both approaches have strengths and limitations and can be used to complement each other in fundamental analysis.

How is fundamental analysis applied in trading?

Fundamental analysis is applied in trading by incorporating it into trading strategies and decision-making processes. Traders can consider fundamental factors such as company earnings, economic indicators, and industry trends to determine the potential value and direction of an asset. This analysis can help traders make more informed trading decisions and enhance the effectiveness of their overall trading strategies.

What is the difference between systematic and discretionary trading styles in relation to fundamental analysis?

Systematic trading involves using predefined rules and algorithms to make trading decisions, while discretionary trading relies on the trader’s judgment and intuition. Fundamental analysis can be applied in both trading styles, with systematic traders using data-driven analysis to inform their trading decisions and discretionary traders incorporating fundamental insights into their subjective decision-making process.

Can fundamental analysis be combined with technical analysis in trading?

Yes, fundamental analysis can be combined with technical analysis in trading to gain a more comprehensive view of the market. By considering both fundamental factors, such as company financials and economic indicators, and technical indicators, such as price patterns and volume, traders can make more informed and well-rounded trading decisions.

How can traders fine-tune their trading strategies with the right fundamental analysis strategy?

Traders can fine-tune their trading strategies with the right fundamental analysis strategy by considering their trading style, goals, and risk tolerance. They can tailor their fundamental analysis approach to focus on specific industries or asset classes and use various tools and techniques to gather and analyze relevant data. By aligning their fundamental analysis strategy with their overall trading approach, traders can optimize their decision-making process.

What are some tactical approaches to economic indicators in trading strategies?

Traders can use tactical approaches to economic indicators in trading strategies by monitoring key economic indicators and incorporating them into their decision-making process. They can focus on indicators such as GDP growth, interest rates, inflation rates, and employment data to identify trends and potential trading opportunities. By staying informed about the economic landscape, traders can make more timely and informed trading decisions.

What are the limitations and considerations of fundamental analysis?

Fundamental analysis has some limitations and considerations. It relies on historical data, which may not always accurately predict future trends. It is also subject to biases and investor sentiment, which can influence the effectiveness of the analysis. Additionally, market dynamics and external factors can sometimes override the impact of fundamental analysis. Traders should be aware of these limitations and consider them when incorporating fundamental analysis into their trading strategies.