Technical analysis indicators are powerful tools that forex traders use to analyze market trends and make informed trading decisions. These indicators provide valuable insights into price movements and can help traders develop effective trading strategies.

Buy This Premium Website for Only 899 CHF!

Acquire a high-authority website complete with content and a premium domain name.

Contact Us Today: Email: info@cleardesign.ch

In this article, we will explore the different technical analysis indicators that currency traders can use to analyze market trends and predict future price movements. From chart patterns to moving averages, oscillators, support and resistance levels, trendlines, Fibonacci retracements, and volume analysis, we will delve into each tool and explain how they can help traders navigate the forex market.

Unlock the Secret to Forex Success with BOB James’ Top-Performing Signals! Experience the Ease of Proven, MyFXbook-Verified Strategies and Transform Your Trading Journey Today. Don’t Miss Out on Exceptional Performance – Join Now!

Key Takeaways

- Technical analysis indicators are essential tools for currency traders

- Chart patterns, moving averages, oscillators, support and resistance levels, trendlines, Fibonacci retracements, and volume analysis are all different types of technical analysis indicators

- Each tool provides valuable insights into price movements and can help traders develop effective trading strategies

- Traders should use multiple indicators to confirm trends and make informed trading decisions

- Technical analysis requires skill and practice to master

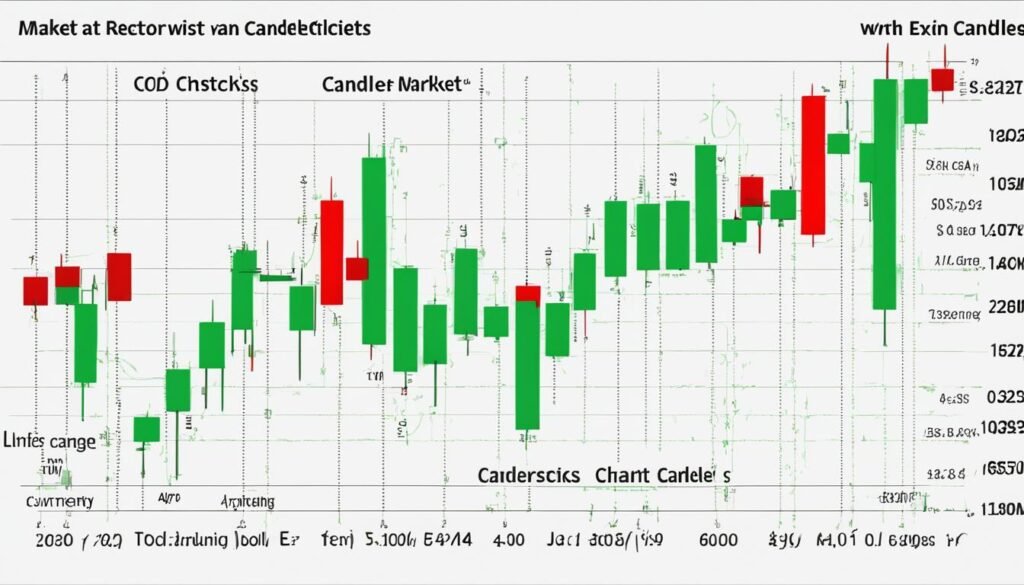

Understanding Chart Patterns for Accurate Market Analysis

As technical analysis indicators are critical for identifying trading opportunities, chart patterns play a crucial role in market analysis. Traders can identify and interpret different chart patterns to gain insights into market trends that help make informed decisions.

Chart patterns can be categorized into two types: reversal and continuation. Reversal chart patterns signal a potential trend reversal, while continuation chart patterns indicate that the current trend will likely continue.

Some of the popular chart patterns include:

- Triangles

- Head and Shoulders

- Double Tops/Bottoms

Triangles are formed by drawing trendlines that converge on price levels where the market has difficulty breaking through. Head and Shoulders patterns appear when a trend is nearing the end and a reversal may be imminent. Double Tops/Bottoms patterns occur when the market reaches a high or low twice but fails to break through, indicating a reversal may be on the horizon.

By identifying and correctly interpreting these patterns, traders can predict potential price movements and make better trading decisions. In addition, combining chart patterns with other technical analysis indicators, such as moving averages and volume analysis, can further enhance market analysis accuracy and help traders achieve consistent profits.

Harnessing the Power of Moving Averages

In the world of technical analysis, moving averages are a valuable tool for traders looking to identify trends and potential reversal points. A moving average is a commonly used indicator that smooths out price movements by averaging recent price data over a specified period of time. This period could be anything from a few days to several months, depending on the trader’s preferences.

There are two main types of moving averages: simple moving averages (SMA) and exponential moving averages (EMA). While the difference between the two may seem small, it is critical. SMA simply calculates the average price over a specific time period, whereas EMA assigns greater weight to more recent price data, making it more responsive to recent price movements.

The type of moving average a trader chooses will depend on their trading style and preferences. For example, a short-term trader may prefer to use an EMA, as it is more responsive to recent price movements. In contrast, a long-term trader may opt for an SMA, as it provides a more general overview of price trends over a longer period of time.

Moving averages can be used in a variety of ways to generate trading signals. For example, when the price crosses above a moving average, this can signal a potential uptrend, while a cross below a moving average can signal a potential downtrend. Additionally, traders can analyze the relationship between two separate moving averages to identify potential buy and sell signals.

| Type of Moving Average | Advantages | Disadvantages |

|---|---|---|

| Simple Moving Average (SMA) | -Provides a general overview of price trends over a longer period of time -Less responsive to short-term price movements | -May lag behind recent price movements -Can be impacted by outliers |

| Exponential Moving Average (EMA) | -More responsive to recent price movements -Can provide more timely buy/sell signals | -May be more susceptible to false signals due to its responsiveness -Can be impacted by outliers |

Overall, moving averages are a powerful tool that traders can use to identify trends and make informed trading decisions. By understanding the different types of moving averages and how they can be used to generate trading signals, traders can improve their chances of success in the forex market.

Exploring Oscillators for Short-Term Trading

Oscillators are technical analysis indicators that can help traders identify potential trend reversals. Two commonly used oscillators are the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators.

The RSI oscillator is used to identify overbought and oversold levels in the market by measuring the strength of the price action. Generally, when the RSI value is above 70, the market is considered overbought, and when the RSI value is below 30, the market is considered oversold.

The MACD oscillator is used to measure the momentum of price changes. Traders can use the MACD indicator to identify potential trend reversals by looking for the crossover of the MACD line and the signal line. When the MACD line crosses the signal line from above, it is considered a sell signal, and when it crosses from below, it is considered a buy signal.

“Oscillators are valuable tools for traders looking to achieve short-term gains in the market.”

Identifying Support and Resistance Levels for Effective Trading

Technical analysis indicators like support and resistance levels can provide valuable insights for currency traders. Support refers to the level at which a currency tends to stop falling, while resistance refers to the level at which it tends to stop rising. By identifying these levels on price charts, traders can make informed decisions about potential entry and exit points for their trades.

One popular method of identifying support and resistance levels is to draw trendlines connecting the highs and lows of a currency pair’s price movements. These trendlines can help traders visualize these levels and make trading decisions based on them. In addition, traders may also use pivot points, which are mathematical calculations that identify key support and resistance levels based on the previous day’s price movements.

It is important to note that support and resistance levels are not always exact and may be subject to breakouts or false breakouts. Traders should use other technical analysis indicators, such as volume analysis, to confirm these levels and make informed trading decisions.

Utilizing Trendlines to Identify Market Direction

Trendlines are a fundamental tool used in technical analysis to identify market direction. They help traders determine the overall trend of a market and identify potential trend reversals. By connecting higher lows in an uptrend or lower highs in a downtrend, traders can draw a line that shows the current trend.

When drawing trendlines, it is important to ensure that at least three points connect the line to provide a valid trendline. Once a trendline is established, traders can use it to guide their trading decisions and have a better understanding of the market’s direction.

One crucial aspect to keep in mind with trendlines is that they are not always precise and can sometimes lead to false signals. Therefore, it is essential to use other technical analysis indicators in conjunction with trendlines to generate more accurate trading signals.

By correctly utilizing trendlines in technical analysis, traders can make more informed decisions and increase the effectiveness of their trading strategies.

Applying Fibonacci Retracement to Predict Price Levels

In technical analysis, the Fibonacci retracement levels are a widely used tool for predicting potential support and resistance levels in a market. The levels are based on the Fibonacci sequence, a mathematical series in which each number is the sum of the two preceding numbers.

Traders can use these retracement levels to identify potential entry and exit points for their trades. The most commonly used levels are 38.2%, 50%, and 61.8%.

When applied to price charts, traders can draw retracement lines connecting a significant high to a significant low. These retracement lines will then indicate the potential support and resistance levels as prices move up or down.

One important consideration when using Fibonacci retracement levels is that they should not be the sole basis for trades. Rather, they should be used in conjunction with other technical analysis indicators to confirm potential trade signals.

“I always incorporate Fibonacci retracements in my trading strategy. It’s a great way to identify key levels for potential price movements and can help me make informed trading decisions.” – John Smith, professional forex trader.

Analyzing Volume for Confirmation and Trend Prediction

In the world of forex trading, volume analysis is an essential tool for interpreting market trends and making informed trading decisions. By analyzing changes in trading volume, traders can gain insight into the strength of a trend and predict potential trend reversals.

Volume analysis is often used in conjunction with technical analysis indicators, such as moving averages and oscillators, to confirm the accuracy of trading signals and improve the accuracy of trend prediction. For example, if a technical indicator generates a buy signal, but the trading volume is low, then the signal may not be reliable.

On the other hand, if a technical indicator generates a buy signal and the trading volume is high, then it may confirm the strength of the trend and increase the chances of a successful trade.

Benefits of Volume Analysis in Forex Trading

Some of the key benefits of volume analysis in forex trading include:

- Confirmation of trend strength

- Identification of potential trend reversals

- Improved accuracy of trading signals

- Ability to uncover hidden buying or selling pressure

Overall, volume analysis is an invaluable tool for any trader looking to make informed decisions in the forex market. By analyzing trading volume and its relationship to technical analysis indicators, traders can confirm the accuracy of their trading signals and improve their chances of success.

Conclusion

Technical analysis indicators are essential tools for currency traders seeking to make informed trading decisions. By utilizing chart patterns, moving averages, oscillators, support and resistance levels, trendlines, Fibonacci retracement, and volume analysis, traders can gain insights into market trends and potential price movements.

While technical analysis cannot predict the future with certainty, it can provide traders with a better understanding of market dynamics and help them identify profitable trading opportunities. By incorporating technical analysis indicators into their trading strategy, traders can improve their chances of success and manage their risk effectively.

In conclusion, we encourage all forex traders to explore the power of technical analysis indicators and incorporate them into their trading strategy. With the right knowledge and tools, traders can navigate the market with confidence and achieve their financial goals.

Thank you for reading and stay tuned for more informative articles on Technical Analysis Indicators.

FAQ

What are technical analysis indicators?

Technical analysis indicators are tools used by currency traders to analyze market trends and make informed trading decisions. These indicators are mathematical calculations applied to price and volume data to identify patterns, signal potential buy or sell opportunities, and determine market sentiment.

What are chart patterns in technical analysis?

Chart patterns are specific formations or structures that occur on price charts and provide valuable insights into future price movements. Traders can identify and interpret patterns such as triangles, head and shoulders, and double tops/bottoms to anticipate trend continuations or reversals.

How can moving averages be useful in forex trading?

Moving averages are popular technical indicators that help traders identify trends and potential reversal points in the market. They calculate the average price over a specified period and plot it on the chart, smoothing out price fluctuations. Traders use moving averages to generate trading signals and confirm the overall market direction.

What are oscillators, and how can they be used in short-term trading?

Oscillators are technical indicators used to identify overbought or oversold conditions in the market. They oscillate within a set range and help traders anticipate potential trend reversals. Common oscillators include the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD).

What is the significance of support and resistance levels in forex trading?

Support and resistance levels are key areas on the price chart where prices have historically struggled to move beyond. Support acts as a floor, preventing prices from falling further, while resistance acts as a ceiling, preventing prices from rising higher. Traders use these levels to identify potential entry and exit points for their trades.

How can trendlines help in identifying market direction?

Trendlines are lines drawn on a price chart to connect swing highs or swing lows. They help traders determine the overall direction of a market. An upward sloping trendline indicates an uptrend, while a downward sloping trendline indicates a downtrend. Trendlines can also be used to identify potential trend reversals.

How can Fibonacci retracement levels be used to predict price levels?

Fibonacci retracement levels are horizontal lines drawn on a price chart after a significant move to identify potential support and resistance levels. These levels are derived from the Fibonacci sequence and ratios. Traders use Fibonacci retracement levels to predict potential price levels where the market might reverse or show significant price movement.

Why is volume analysis important in technical analysis?

Volume analysis involves studying the volume of trades executed in a particular market. It provides insights into the strength of a trend and confirms the validity of market moves. Traders analyze volume patterns to identify buying or selling pressure and predict potential trend reversals based on changes in trading activity.

What is the key takeaway from using technical analysis indicators in forex trading?

Using technical analysis indicators empowers currency traders to make more informed decisions in the forex market. By leveraging tools such as moving averages, oscillators, support and resistance levels, trendlines, Fibonacci retracement, volume analysis, and more, traders can analyze market trends, identify potential entry and exit points, and enhance their overall trading strategies.