Welcome to our comprehensive guide on fundamental analysis for currency traders. In this article, we will dive into the world of economic indicators and discuss how they play a crucial role in currency trading. Whether you’re a beginner or an experienced trader, understanding fundamental analysis is essential for making informed trading decisions.

Fundamental analysis involves examining economic, social, and political factors to evaluate the intrinsic value of a currency. By analyzing these key indicators, traders can gain insights into the overall health of an economy and predict potential currency movements. This analysis allows traders to identify trading opportunities and manage risk effectively.

Unlock the Secret to Forex Success with BOB James’ Top-Performing Signals! Experience the Ease of Proven, MyFXbook-Verified Strategies and Transform Your Trading Journey Today. Don’t Miss Out on Exceptional Performance – Join Now!

Key Takeaways:

- Fundamental analysis is a vital tool for currency traders, as it helps them understand the fundamental factors driving currency values.

- Economic indicators provide invaluable insights into the health of an economy and can be used to anticipate future currency movements.

- Traders should pay attention to indicators such as Gross Domestic Product (GDP), Consumer Price Index (CPI), and central bank policies to make informed trading decisions.

- Fundamental analysis is not the only form of analysis in currency trading. It should be complemented by technical analysis to have a comprehensive trading strategy.

- Staying updated on economic news and global events is crucial for currency traders to adapt their strategies according to market conditions.

Now that we have set the stage, let’s delve deeper into the world of forex fundamental analysis and explore the essential concepts, tools, and strategies that can help you become a successful currency trader.

Introduction to Forex Fundamental Analysis

Welcome to the world of forex fundamental analysis, a crucial aspect of currency trading that focuses on understanding and analyzing the impact of economic, social, and political factors on currency values. In this section, we will provide an introduction to forex fundamental analysis, explaining what it is and how it differs from technical analysis. We will also delve into the importance of economic, social, and political factors in currency trading and explore how they can influence the forex market.

Defining Forex Fundamental Analysis

Forex fundamental analysis is a method used by currency traders to understand the intrinsic value of a currency. It involves analyzing economic data, social trends, and political events that can affect a country’s economy and subsequently impact its currency. Unlike technical analysis, which focuses on historical price patterns, fundamental analysis seeks to identify the underlying causes of currency movements.

By examining various economic indicators, such as GDP growth rates, interest rates, inflation, employment data, and trade balances, fundamental analysts aim to assess a country’s economic health and make predictions about its currency’s future performance. Additionally, fundamental analysis takes into account social and political factors, such as demographic trends, social unrest, and political stability, as they can also influence a currency’s value.

The Importance of Economic, Social, and Political Factors

Economic Factors: Economic factors play a crucial role in forex fundamental analysis. Key economic indicators provide valuable insights into a country’s economic performance and growth prospects, directly impacting its currency. For example, positive GDP growth, low unemployment rates, and rising industrial production often lead to a stronger currency, as they indicate a robust economy. On the other hand, a slowdown in economic growth or a recession can weaken a currency.

Social Factors: Social factors encompass a wide range of influences, from consumer behavior to cultural shifts, that can impact a country’s economic landscape. Understanding social trends is essential, as they can influence consumer spending patterns, business investments, and overall economic sentiment. Changes in demographics, lifestyle preferences, and social values can have indirect effects on currency values through their impact on economic activity.

Political Factors: Political factors, including government policies, geopolitical events, and political stability, can significantly impact currency values. Elections, changes in government leadership, and political instability can create volatility in the forex market. Additionally, political decisions such as fiscal policies, monetary policies, and trade agreements can directly influence a country’s economy and subsequently its currency. Traders need to closely monitor political developments to assess their potential effects on currency movements.

Understanding Economic Indicators for Currency Traders

As a currency trader, it is essential to have a deep understanding of economic indicators and their significance in the forex market. Economic indicators are statistical data points that provide insights into the overall health and performance of an economy. By analyzing these indicators, traders can gain valuable insights that can inform their trading decisions.

So, what exactly are economic indicators?

Economic indicators are quantitative data points that measure various aspects of an economy, such as employment levels, inflation rates, consumer spending, and GDP growth. These indicators are released regularly by government agencies, central banks, and other economic institutions. They are used by traders and economists to gauge the current and future state of an economy.

There are numerous economic indicators that traders should be familiar with. Some of the key indicators include:

- Gross Domestic Product (GDP)

- Consumer Price Index (CPI)

- Unemployment Rate

- Interest Rates

- Retail Sales

- Industrial Production

- Trade Balance

Each of these indicators provides valuable information about different aspects of the economy. For example, GDP measures the overall economic output of a country, while CPI tracks inflation levels. Unemployment rates indicate the health of the job market, and interest rates reflect monetary policy decisions.

By monitoring and analyzing these economic indicators, currency traders can gain insights into the strength or weakness of a particular economy and its currency. For instance, strong GDP growth may indicate a robust economy, leading to an appreciation of the currency. On the other hand, rising inflation rates might signal a weakening currency.

Using economic indicators in currency trading

When incorporating economic indicators into their trading strategies, currency traders must understand both the significance of the indicator and how it relates to the currency pair they are trading. It’s important to consider how other fundamental and technical factors may influence the currency market.

Traders can use economic indicators to identify potential trading opportunities and make informed decisions. For example, if the CPI data is significantly higher than expected, it may signal potential inflationary pressures, prompting traders to consider selling the currency.

It’s crucial to note that economic indicators can have varying degrees of impact on currency markets. Some indicators may have immediate and significant effects, while others may have a more long-term influence. Traders must consider the context and broader market conditions when interpreting and reacting to economic indicators.

Ultimately, understanding and effectively utilizing economic indicators can provide currency traders with valuable insights into market trends, potential risks, and opportunities. By staying informed and up-to-date with economic data releases, traders can enhance their ability to make well-informed trading decisions in the forex market.

Next, we will explore the influence of central bank policies on the forex market and how interest rate decisions and quantitative easing programs can impact currency valuation.

Assessing Central Bank Policies and Their Effect on Forex

In the world of forex trading, central bank policies play a crucial role in influencing currency markets. Traders closely monitor the decisions and actions of central banks as they have a significant impact on currency values. In this section, we will explore the relationship between central bank policies and the forex market, focusing on the impact of interest rate decisions and quantitative easing programs.

The Impact of Interest Rate Decisions

One of the key tools used by central banks to manage their respective economies is the adjustment of interest rates. When a central bank raises interest rates, it signals a tightening of monetary policy and aims to curb inflationary pressures. This, in turn, can attract foreign investors seeking higher yields, leading to a stronger currency. On the other hand, when interest rates are lowered, it stimulates borrowing and spending, which can weaken the currency.

Interest rate decisions, therefore, have a direct impact on currency valuation. Traders analyze central bank statements, press conferences, and economic data to anticipate interest rate changes, enabling them to position themselves accordingly in the forex market.

Quantitative Easing and Currency Valuation

Quantitative easing is another policy tool used by central banks to stimulate economic growth. It involves the purchase of government bonds and other financial assets by the central bank, injecting liquidity into the economy. This increases the money supply, lowers interest rates, and encourages lending and investment.

The impact of quantitative easing on currency valuation is more nuanced. Initially, the additional liquidity can lead to a depreciation of the currency as the market becomes flooded with supply. However, if the quantitative easing program is successful in boosting economic growth, it can increase investor confidence and attract foreign capital, thereby strengthening the currency in the long run.

Understanding the relationship between quantitative easing and currency valuation is essential for forex traders as it allows them to gauge the potential impact on their trading positions and risk management strategies.

In summary, central bank policies, such as interest rate decisions and quantitative easing programs, have a significant influence on the forex market. Traders need to closely monitor these policies and assess their implications on currency valuation to make informed trading decisions.

Evaluating Geopolitical Influence on Currency Markets

In the fast-paced world of currency trading, geopolitical events play a crucial role in shaping the fortunes of different currencies. It is essential for currency traders to understand the impact of geopolitical influences on currency markets to make informed trading decisions.

Geopolitical factors such as political instability, trade wars, and international conflicts can have a significant effect on currency values. These events can create uncertainty and volatility in the markets, leading to fluctuations in currency exchange rates.

To navigate these geopolitical influences effectively, currency traders need to stay informed about global political developments. Monitoring news and staying updated with current events can provide valuable insights into potential shifts in currency markets.

For example, political instability in a major trading partner country can lead to a decrease in demand for that country’s currency, causing its value to depreciate. Conversely, improved political stability can boost confidence in a currency and lead to its appreciation.

Trade wars and international conflicts between countries can also impact currency values. Imposition of tariffs, trade restrictions, or diplomatic tensions can create uncertainty and disrupt international trade flows, which can have adverse effects on currency markets.

To effectively evaluate the geopolitical influence on currency markets, traders need to consider not only the immediate impact of political events but also their long-term implications. Analyzing trends and correlations can help identify patterns and anticipate potential currency movements.

By understanding and evaluating geopolitical influences, currency traders can enhance their ability to anticipate and respond to market dynamics. It is crucial to incorporate geopolitical analysis into the broader framework of fundamental analysis to gain a holistic view of the currency markets.

Benefits of Implementing Fundamental Analysis in Currency Trading

Incorporating fundamental analysis into currency trading strategies can provide numerous benefits for traders. By understanding the underlying factors that drive currency movements, traders can gain predictive insights and identify long-term trading opportunities. Let’s explore these benefits in more detail.

Predictive Insights for Currency Movements

Fundamental analysis allows traders to analyze economic, social, and political factors that influence currency values. By staying informed about key economic indicators, such as GDP growth, inflation rates, and employment data, traders can make more accurate predictions about future currency movements. This insight enables them to anticipate market trends and adjust their trading strategies accordingly.

Spotting Long-Term Trading Opportunities

One of the main advantages of fundamental analysis is its ability to identify long-term trading opportunities. By examining macroeconomic trends and geopolitical events, traders can anticipate shifts in currency values over extended periods. This can be particularly valuable for traders who prefer a long-term trading approach, as it allows them to position themselves early and potentially capture significant gains.

Additionally, fundamental analysis helps traders identify undervalued or overvalued currencies, providing opportunities for profitable trades. By assessing the economic fundamentals of different countries, traders can identify currencies that are expected to strengthen or weaken in the long run, allowing them to strategically enter trades and potentially generate higher returns.

Bringing it all together with Fundamental Analysis

A successful currency trader combines technical and fundamental analysis to gain a comprehensive understanding of the market. While technical analysis focuses on charts and patterns, fundamental analysis provides the underlying reasons behind currency movements. By incorporating both approaches, traders can make more informed and strategic trading decisions.

By leveraging the benefits of fundamental analysis, traders can enhance their overall trading performance and increase their chances of success in the forex market. The ability to gain predictive insights and identify long-term trading opportunities can give traders a competitive edge and help them navigate the dynamic currency markets with confidence.

| Benefits of Fundamental Analysis |

|---|

| Predictive insights into currency movements |

| Identification of long-term trading opportunities |

| Enhanced trading performance |

| Increased chances of success in the forex market |

Step-by-Step Approach to Forex Fundamental Analysis

In this section, we will provide a step-by-step approach to conducting forex fundamental analysis. By following these steps, traders can enhance their decision-making process and improve their chances of success in the forex market.

Gathering and Utilizing Economic Data

The first step in forex fundamental analysis is to gather relevant economic data. This data includes a wide range of indicators such as GDP, inflation rates, employment figures, and consumer sentiment. Traders can access this data through various sources, including government websites, economic calendars, and financial news platforms.

Once the economic data is collected, traders must analyze and interpret its meaning in the context of the currency market. This involves understanding the relationship between economic variables and currency movements. Traders can use this data to gauge the overall health of an economy and identify potential trading opportunities.

Interpreting Economic Indicators for Trade Decisions

The second step in forex fundamental analysis is to interpret the economic indicators and use them to make trade decisions. Each economic indicator provides valuable insights into specific aspects of an economy. Traders must understand how these indicators interact and impact currency values.

For example, a positive GDP growth rate indicates a healthy economy, which can lead to a stronger currency. On the other hand, high inflation rates may erode the value of a currency. By interpreting these indicators correctly, traders can identify potential trends and adjust their trading strategies accordingly.

In addition to economic indicators, traders should also consider other factors such as central bank policies, geopolitical events, and market sentiment. These factors can significantly influence currency values and should be taken into account when making trade decisions.

Overall, a step-by-step approach to forex fundamental analysis involves gathering and utilizing economic data effectively and interpreting economic indicators with a deep understanding of their implications. By following this approach, traders can make informed trading decisions and increase their chances of success in the forex market.

The Distinction Between Fundamental and Technical Analysis in Forex

In the world of forex trading, two primary methods are used to analyze currency markets: fundamental analysis and technical analysis. While both approaches aim to provide insights into market trends and potential trading opportunities, they differ in their focus and methodology. Understanding the distinction between fundamental and technical analysis is essential for traders to develop a well-rounded trading strategy.

Fundamental analysis involves the evaluation of various economic, social, and political factors that can influence currency values. Traders who utilize fundamental analysis examine key indicators such as GDP growth rates, interest rate decisions, inflation levels, and geopolitical events. By assessing these factors, they seek to understand the intrinsic value of a currency and predict its future direction.

On the other hand, technical analysis relies on historical price data and statistical indicators to forecast future price movements. Traders employing technical analysis use charts, patterns, and mathematical tools to identify trends, support and resistance levels, and potential entry and exit points. They focus on price action and trading volume to make informed trading decisions.

While distinct in their approaches, fundamental and technical analysis are not mutually exclusive. Traders often combine these methods to gain a comprehensive understanding of the forex market. By integrating fundamental analysis, traders can identify long-term trends and major market shifts. Technical analysis, on the other hand, assists in pinpointing entry and exit points within those larger trends.

“Fundamental analysis helps me understand the underlying forces driving currency movements, while technical analysis helps me time my trades more effectively. By using both methods, I can increase my trading accuracy and make more informed decisions.”

By utilizing both fundamental and technical analysis, traders can take advantage of a broader range of trading opportunities. They can identify potential currency pairs with strong fundamental factors and then use technical analysis to fine-tune their entry and exit points.

Ultimately, a comprehensive trading strategy often involves a balance between fundamental and technical analysis. Traders can leverage the distinct advantages of each approach to gain a competitive edge in the dynamic forex market.

Economic Indicators: Tools to Navigate the Forex Market

In the forex market, staying informed about economic indicators is crucial for currency traders. These indicators provide valuable insights into the health and performance of economies, helping traders make informed trading decisions. In this section, we will explore two key economic indicators that play a significant role in the forex market: Gross Domestic Product (GDP) and Consumer Price Index (CPI).

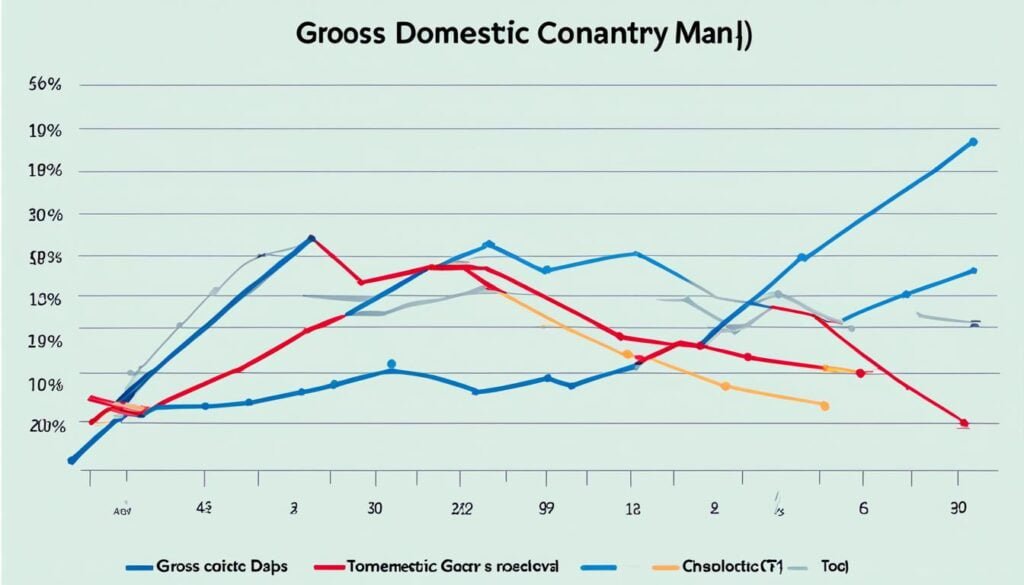

Gross Domestic Product (GDP) as a Growth Indicator

Gross Domestic Product (GDP) is a vital economic indicator that measures the total value of goods and services produced within a country’s borders during a specific period. It serves as a gauge of economic growth and productivity. For currency traders, changes in GDP can signal the strength or weakness of an economy, affecting currency values.

Traders typically monitor GDP reports regularly to identify trends and potential trading opportunities. If a country’s GDP is growing steadily or exceeding expectations, it may signal a strong domestic economy, attracting foreign investment and potentially leading to an appreciation of the currency. Conversely, a decline in GDP growth can indicate economic contraction and may lead to a depreciation in the currency.

Understanding CPI and its Impact on Forex

The Consumer Price Index (CPI) is another vital economic indicator that measures the average changes in prices of a basket of goods and services commonly consumed by households. CPI provides insight into inflation trends, which can have a significant impact on the forex market.

For currency traders, understanding the CPI is essential as it affects the purchasing power of consumers and can influence interest rates and monetary policy decisions. Inflationary pressures, indicated by rising CPI, may lead central banks to tighten monetary policies, which can potentially strengthen a currency. On the other hand, persistently low CPI or deflationary trends may prompt central banks to adopt accommodative measures, potentially weakening a currency.

By closely monitoring CPI data releases and analyzing their implications on monetary policy, traders can gain insights into potential currency movements and adjust their trading strategies accordingly.

| Economic Indicator | Description | Impact on Forex Market |

|---|---|---|

| Gross Domestic Product (GDP) | Measures the total value of goods and services produced within a country’s borders during a specific period. | Affects currency values based on changes in economic growth and productivity. |

| Consumer Price Index (CPI) | Measures the average changes in prices of commonly consumed goods and services. | Influences currency values through its impact on inflation, interest rates, and monetary policy decisions. |

Monetary Policy and its Influence on Forex Trading Strategies

In the world of forex trading, understanding monetary policy and its influence is crucial for developing effective trading strategies. Monetary policy refers to the actions and decisions undertaken by central banks to control the money supply, interest rates, and economic stability. These policies play a significant role in shaping currency values and market dynamics.

Central banks, such as the Federal Reserve (Fed) in the US, the European Central Bank (ECB) in the Eurozone, and the Bank of Japan (BoJ), have the power to use monetary policy tools to influence their respective economies. By adjusting interest rates, implementing quantitative easing measures, or intervening in currency markets, central banks aim to achieve goals such as price stability, economic growth, and full employment.

The decisions made by central banks have a direct impact on currency values and forex trading strategies. For example, when a central bank raises interest rates, it can attract foreign investors seeking higher returns on their investments. This increased demand for the currency can lead to its appreciation in the forex market.

Conversely, when a central bank lowers interest rates, it can encourage borrowing and spending, stimulating economic growth. However, this can also lead to a depreciation of the currency as investors may seek higher returns elsewhere.

Traders need to closely monitor central bank announcements, policy statements, and economic indicators to stay informed about potential changes in monetary policy. By understanding the potential impact of these decisions on currency values, traders can adjust their trading strategies accordingly.

Some forex trading strategies that can be influenced by monetary policy include:

- Carry trading: This strategy involves taking advantage of interest rate differentials between two currencies. Traders borrow low-interest-rate currencies to finance the purchase of higher-yielding currencies, aiming to profit from the interest rate spread.

- News trading: Traders can capitalize on significant monetary policy announcements or central bank decisions by entering trades based on the market reaction to these events. Quick and decisive action is often required for this strategy.

- Trend trading: Traders can use long-term trends in currency pairs influenced by monetary policy to identify trading opportunities. By analyzing the long-term effects of central bank decisions on currency values, traders can make informed decisions about entering or exiting positions.

Understanding the influence of monetary policy on forex trading strategies allows traders to adapt to changing market conditions, enhance their risk management, and capitalize on potential opportunities. By staying informed and adjusting their strategies accordingly, traders can navigate the dynamic world of forex trading with greater confidence and success.

Real-World Application of Fundamental Analysis in Forex Markets

In this section, we will explore the real-world application of fundamental analysis in forex markets. By understanding how fundamental analysis can be used to make informed trading decisions, traders can enhance their strategies and improve their chances of success. We will discuss two key aspects of applying fundamental analysis: trading on news and analyzing currency correlations.

Trading on News: How to Capitalize on Economic Releases

One of the primary ways to leverage fundamental analysis in forex trading is by trading on news. Economic releases, such as employment data, inflation figures, and central bank statements, can significantly impact currency prices. By analyzing these releases and their potential impact, traders can position themselves to capitalize on short-term price movements.

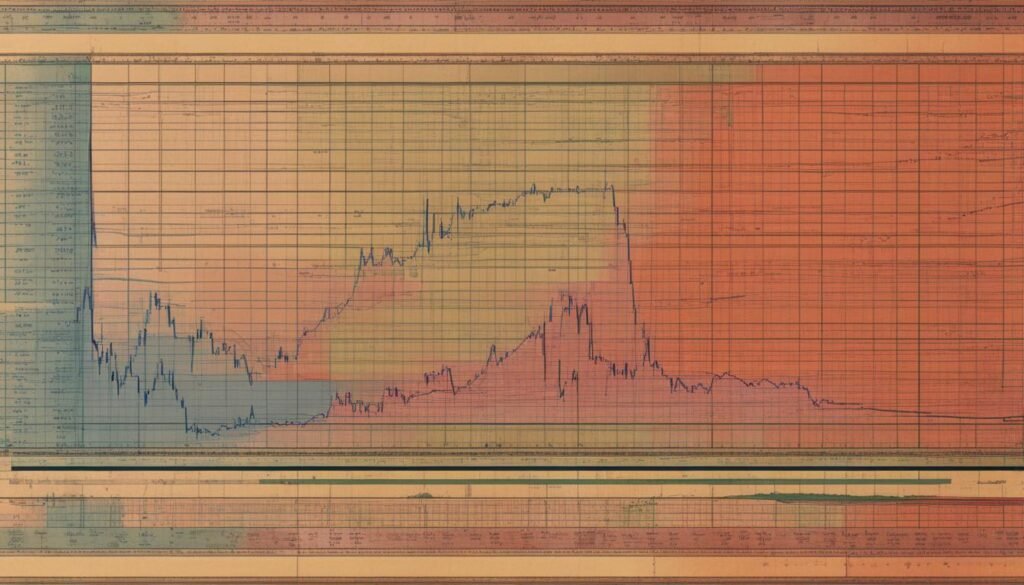

The image above visually represents the excitement and opportunity that trading on news can bring. By staying updated with economic events and their potential effects on currency markets, traders can quickly react to market shifts and take advantage of profitable trading opportunities.

When trading on news, it’s crucial to have a comprehensive understanding of the specific economic indicator and its significance. Traders should keep track of the release schedule, study market expectations, and be prepared for market reactions. By combining fundamental analysis with careful risk management and technical analysis, traders can make informed decisions and minimize potential risks.

Analyzing Currency Correlations and Forex Market Dynamics

In addition to trading on news, analyzing currency correlations and understanding forex market dynamics is an essential aspect of fundamental analysis. Currency correlations refer to the relationship between two currency pairs and how they move in relation to each other.

By examining currency correlations, traders can identify patterns and trends that can help them predict future price movements. For example, if there is a strong positive correlation between two currency pairs, a trader can use this information to confirm their trading decision or devise a hedging strategy. Conversely, a negative correlation may indicate an opportunity for diversification.

To analyze currency correlations effectively, traders can use various tools and resources, such as correlation matrices or specialized software. These tools provide valuable insights into the relationship between currency pairs and can help traders make informed trading decisions based on their analysis.

Understanding forex market dynamics is crucial for successful trading. By studying market trends, liquidity, and order flow, traders can gain a deep understanding of market behavior and make better-informed trading decisions.

Table

| Currency Pair | Correlation Coefficient |

|---|---|

| EUR/USD | +0.72 |

| GBP/USD | +0.85 |

| USD/JPY | -0.56 |

The table above displays the correlation coefficients between various currency pairs. Traders can use this data to identify strong correlations (+0.70 to +1.00) or significant negative correlations (-0.70 to -1.00). By understanding these relationships, traders can adapt their strategies accordingly and capitalize on potential opportunities.

By incorporating trading on news and analyzing currency correlations, traders can maximize the effectiveness of fundamental analysis in forex markets. These strategies provide valuable insights into short-term market movements and enhance the overall decision-making process, helping traders stay ahead of the curve and increase their profitability.

Conclusion

In conclusion, fundamental analysis plays a crucial role in currency trading. By understanding the economic indicators, traders can make informed decisions and navigate the forex market more effectively.

Throughout this comprehensive guide, we have highlighted the significance of economic, social, and political factors in currency valuation. We have explored the impact of central bank policies, geopolitical events, and monetary policy on forex trading strategies.

Additionally, we have discussed the benefits of incorporating fundamental analysis into trading strategies, including its ability to provide predictive insights and identify long-term trading opportunities. We have also provided a step-by-step approach to conducting fundamental analysis and emphasized the importance of interpreting economic indicators for trade decisions.

By harnessing the power of fundamental analysis, currency traders can gain a deeper understanding of the forex market and improve their chances of success. Remember to stay updated with economic news, monitor key economic indicators, and adapt your trading strategies accordingly. With a strong foundation in fundamental analysis, you can navigate the dynamic world of currency trading with confidence.

FAQ

What is forex fundamental analysis?

Forex fundamental analysis is a method used by currency traders to evaluate and predict currency movements based on economic, social, and political factors that influence the value of currencies.

How does forex fundamental analysis differ from technical analysis?

While technical analysis focuses on historical price data and chart patterns, forex fundamental analysis looks at economic indicators, social factors, and political events to understand and predict currency movements.

What are the economic indicators that currency traders should be familiar with?

Currency traders should be familiar with economic indicators such as Gross Domestic Product (GDP), Consumer Price Index (CPI), employment reports, interest rates, and trade data.

How do central bank policies affect the forex market?

Central bank policies, such as interest rate decisions and quantitative easing programs, can have a significant impact on currency values. Changes in interest rates and monetary policies can influence investor sentiment and affect currency valuation.

How does geopolitics influence currency markets?

Geopolitical factors, such as political instability, trade wars, and international conflicts, can create volatility and impact currency values. Currency traders need to stay informed about geopolitical events to make informed trading decisions.

What are the benefits of using fundamental analysis in currency trading?

Fundamental analysis provides traders with insights into long-term trends and helps identify potential trading opportunities. It enables traders to understand the underlying factors driving currency movements and make informed decisions.

What is the step-by-step approach to conducting forex fundamental analysis?

The step-by-step approach involves gathering and utilizing economic data, interpreting economic indicators, assessing the impact of social and political factors, and analyzing the overall health of an economy to make informed trade decisions.

What is the difference between fundamental analysis and technical analysis in forex trading?

Fundamental analysis focuses on economic, social, and political factors, while technical analysis looks at historical price data and chart patterns. Both approaches provide valuable insights, and combining them can enhance trading strategies.

How do economic indicators such as GDP and CPI impact forex trading?

Gross Domestic Product (GDP) is an indicator of economic growth and can affect currency values. Consumer Price Index (CPI) measures changes in prices and inflation, which can impact forex trading by influencing interest rates and investor sentiment.

How does monetary policy influence forex trading strategies?

Monetary policy decisions made by central banks, such as changes in interest rates and the implementation of quantitative easing programs, can impact currency values and require traders to adjust their trading strategies accordingly.

Can you provide real-world examples of using fundamental analysis in forex markets?

Fundamental analysis can be applied by trading on news releases, analyzing currency correlations, and understanding the dynamics of the forex market. For example, traders may react to economic data releases or changes in geopolitical events to make trading decisions.